Trump RAGES As Japanese Automakers ABANDON the U.S. — Canada Emerges as the BIG Winner!

In a stunning reversal that’s reshaping the North American automotive landscape, Japan’s biggest car manufacturers are quietly pivoting away from the United States—and Canada is reaping the rewards.

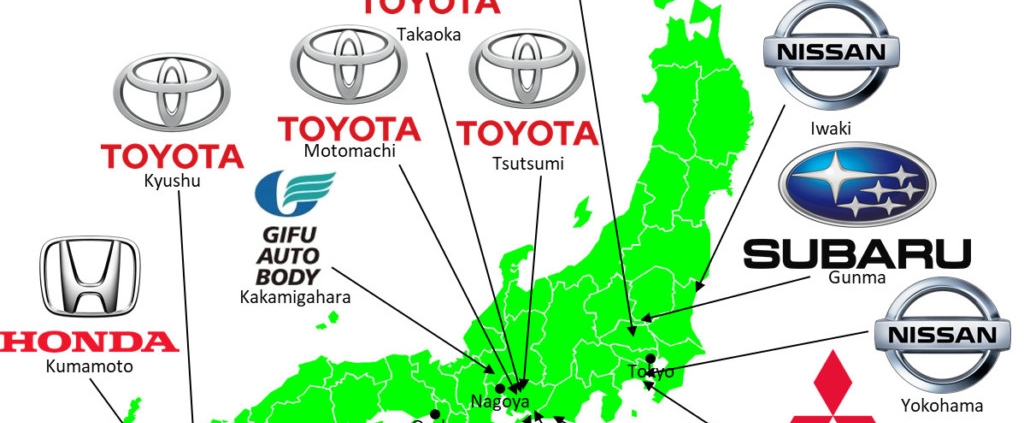

What began as whispers in boardrooms across Tokyo has now crystallized into a full-blown industrial migration, with Toyota, Honda, and Subaru leading an exodus that threatens to upend decades of American manufacturing dominance.

The shift represents more than just corporate relocations; it’s a seismic realignment of economic power that could define the continent’s industrial future for generations to come.

As former President Donald Trump fumes over the developments on social media, calling it a “disaster” and a “betrayal,” the numbers tell an undeniable story: Canada has become the preferred destination for Japanese automotive investment in North America.

The Great Northern Migration

Over the past 18 months, Japanese automakers have announced nearly $15 billion in new investments across Ontario and Quebec, dwarfing comparable commitments south of the border. Toyota’s decision to expand its Cambridge, Ontario plant with a $1.4 billion investment sent shockwaves through the industry, followed swiftly by Honda’s announcement of a $1.8 billion electric vehicle manufacturing facility in Alliston, Ontario.

“What we’re witnessing is nothing short of a industrial revolution,” explains Dr. Margaret Chen, automotive industry analyst at the Brookings Institution. “The Japanese have always been strategic, methodical investors. When they move, they move with purpose and for the long haul.”

Related Post: King Charles REJECTS Starmer’s Orders — London ERUPTS in CHAOS

Subaru’s recent commitment to establish its first full-scale North American manufacturing plant in Ontario—rather than expanding existing U.S. operations—underscores the trend. The $2.3 billion facility, announced in September 2025, will produce the company’s next generation of electric and hybrid vehicles, creating an estimated 4,200 jobs in the process.

The Tariff Trauma That Changed Everything

To understand this exodus, one must rewind to the trade wars that defined much of the 2018-2020 period.

Trump’s aggressive tariff policies, including a 25% duty on steel and aluminum imports and threatened 25% tariffs on all automotive imports, created unprecedented uncertainty for foreign manufacturers operating in the United States.

“The tariffs were intended to bring manufacturing back to America,” notes James Whitlock, trade policy expert at Georgetown University. “Instead, they created an unpredictable business environment that made long-term planning nearly impossible for foreign companies.”

Japanese automakers, who had spent billions integrating themselves into the American manufacturing ecosystem, suddenly found their supply chains disrupted and their profit margins squeezed. The constant threat of new tariffs meant that investments made today could become uneconomical tomorrow—a risk these traditionally conservative companies were unwilling to bear.

Canada, by contrast, offered stability. As a partner in the United States-Mexico-Canada Agreement (USMCA), Canadian-made vehicles could access the American market without tariff penalties, while benefiting from lower operational costs and a more predictable regulatory environment.

Trump’s Fury Unleashed

Former President Trump has not remained silent as this industrial migration unfolds. In a series of posts on Truth Social, Trump has lambasted both the Japanese companies and current U.S. trade policy, calling the situation “a complete disaster for American workers.”

“We gave these companies everything—tax breaks, incentives, protection—and now they’re running to Canada like cowards,” Trump wrote in one particularly fiery post last month. “This is what happens when you have weak leadership that doesn’t know how to negotiate.”

Trump has called for immediate retaliatory measures, including potential tariffs on Canadian-made vehicles and the revocation of tax incentives for Japanese companies that reduce their U.S. workforce. However, trade policy experts suggest such moves could further accelerate the exodus by creating additional uncertainty.

“Trump’s response exemplifies the very problem that drove these companies north in the first place,” argues Sandra Mitchell, economist at the Peterson Institute for International Economics. “Reactive, unpredictable trade policy makes the United States a less attractive investment destination, regardless of market size.”

Ontario: The New Detroit?

Southern Ontario is experiencing an industrial renaissance not seen since the post-World War II boom. The region’s automotive sector, which employs over 125,000 people directly and supports another 375,000 indirect jobs, is undergoing rapid transformation as Japanese investment pours in.

The provincial government has actively courted these investments with competitive incentive packages, but insiders say the real draw is stability and skilled labor. Ontario’s automotive workforce, honed over decades of collaboration with American and Japanese manufacturers, offers the expertise these companies need to execute their electric vehicle transition.

“We’re not just building cars here anymore,” says Frank D’Amico, Mayor of Cambridge, Ontario. “We’re building the future of transportation. These Japanese companies see Ontario as the ideal launchpad for their North American EV strategy.”

The investments are transforming local communities. Real estate prices in automotive corridor cities like Cambridge, Woodstock, and Alliston have surged 40-60% over the past two years. New technical colleges are opening to train the next generation of EV technicians, and suppliers from across Asia and Europe are establishing North American headquarters in the region.

The Supply Chain Follows

Where the major manufacturers go, the supply chain follows. Over 200 Japanese automotive suppliers have either established new Canadian operations or significantly expanded existing facilities since 2023.

This creates a self-reinforcing cycle: as more of the supply chain moves to Canada, it becomes increasingly logical for additional manufacturing to follow.

Denso, one of the world’s largest automotive suppliers, recently announced a $600 million investment in a new Ontario facility that will produce electric vehicle components. Aisin, another major supplier, is building a $400 million transmission plant outside Toronto.

“The supply chain concentration in southern Ontario is reaching critical mass,” explains Dr. Robert Thompson, supply chain specialist at MIT. “At a certain point, it becomes more expensive and complicated to manufacture elsewhere. We may be reaching that tipping point.”

This supply chain migration compounds the challenge for U.S. states trying to retain or attract automotive manufacturing. Even American companies are beginning to eye Canadian expansion to remain close to their suppliers and partners.

The American Response: Too Little, Too Late?

U.S. states are scrambling to respond to the Canadian surge. Michigan, Ohio, and Indiana have all announced new incentive packages designed to retain existing automotive operations and attract new investment.

The Biden administration, and now the Trump administration in its second term, has pushed through substantial subsidies for domestic EV production through the Inflation Reduction Act and subsequent legislation.

However, many industry observers believe the damage may already be done. “Confidence, once lost, is incredibly difficult to rebuild,” notes Patricia Hayes, former Commerce Department official.

“Japanese companies operate on 20-30 year planning horizons. If they’ve decided Canada offers more stability, no short-term incentive will change that calculus.”

The situation is particularly galling for American politicians because much of the Japanese investment in Canada directly serves the U.S. market.

Canadian-made vehicles flow south tariff-free under USMCA, meaning American consumers will continue buying Japanese cars—they’ll just be manufactured by Canadian workers earning Canadian wages and paying Canadian taxes.

Some U.S. lawmakers have proposed renegotiating USMCA to address this imbalance, but legal experts say the agreement’s terms make significant changes unlikely before its 2026 review period.

Beyond Automotive: A Broader Trend

The automotive shift may be just the beginning of a broader industrial realignment. Japanese electronics manufacturers, pharmaceutical companies, and advanced materials producers are all evaluating Canadian expansion as they reassess their North American footprint.

“We’re seeing inquiries across multiple sectors,” confirms Invest Ontario’s CEO, David Barre. “The automotive success has put Canada on the radar for Japanese companies that previously viewed the U.S. as their only North American option.”

This diversification could transform Canada’s economic relationship with Asia, positioning the country as a gateway to North American markets in ways that rival or exceed the U.S. role. For a country that has long played second fiddle to its southern neighbor in attracting foreign investment, the reversal is both remarkable and historic.

The Workers’ Perspective

For American automotive workers, the shift north is devastating. Communities from Michigan to Tennessee that have anchored their economies around automotive manufacturing face an uncertain future. While some Japanese plants remain operational in the U.S., the lack of new investment signals a gradual decline.

“My father worked at this Honda plant, and I’ve worked here for 22 years,” says Michael Rodriguez, a worker at Honda’s Alabama facility. “We keep hearing rumors about downsizing, about shifting production to Canada. It’s terrifying because there aren’t other good jobs like this around here.”

Union leaders have called for government intervention, but the political will appears lacking. With the U.S. focused on broader economic challenges and political divisions, the plight of automotive workers has failed to galvanize decisive action.

Conversely, Canadian automotive workers are experiencing a boom period. Wages are rising, opportunities are expanding, and communities are growing. “We couldn’t find enough qualified workers if we tried,” admits one Ontario plant manager who spoke on condition of anonymity. “Companies are literally competing for talent with signing bonuses and enhanced benefits packages.”

The Geopolitical Dimension

This industrial shift carries geopolitical implications beyond economics. As tensions between the U.S. and China continue, Japan’s position as a key American ally in the Pacific makes these investments particularly significant. The fact that Japanese companies are reducing their U.S. exposure—even modestly—suggests a hedging strategy that would have been unthinkable a decade ago.

“Japan is subtly rebalancing its relationship with North America,” argues Dr. Yuki Tanaka, international relations professor at Stanford University. “They’re not abandoning the U.S., but they’re creating optionality. If American trade policy becomes more erratic, they have a foothold elsewhere.”

This hedging extends to other sectors. Japanese financial institutions are increasing their Canadian investments, and cultural exchanges between Japan and Canada have intensified markedly. While the U.S.-Japan alliance remains robust, the unquestioned primacy of that relationship is evolving.

What Comes Next?

As 2025 progresses, the trend shows no signs of reversing. Industry sources suggest additional major announcements are forthcoming, with Nissan and Mazda both reportedly considering significant Canadian investments.

If these materialize, Canada’s position as the center of Japanese automotive manufacturing in North America will be cemented.

For the United States, the challenge is formidable. Rebuilding trust with Japanese manufacturers will require sustained policy stability—something that has proven elusive in recent years.

Without it, the dream of an American manufacturing renaissance may continue to recede, replaced by the reality of Canadian industrial ascendance.

Trump’s rage, however justified he may feel it to be, cannot alter the fundamental economics driving this shift. In the global competition for investment and jobs, Canada has outmaneuvered its southern neighbor through a combination of strategic policy, stable governance, and opportunistic timing.

The question now is whether this represents a temporary aberration or a permanent realignment. If history is any guide, industrial shifts of this magnitude rarely reverse themselves quickly. What began as a trickle of Japanese investment northward may well become the flood that reshapes North American manufacturing for decades to come.

For Canada, the moment represents vindication and opportunity. For the United States, it’s a wake-up call that size and history are no longer sufficient to guarantee economic preeminence. And for Japan’s automakers, it’s proof that adaptability and strategic thinking remain their greatest competitive advantages in an increasingly uncertain world.

Citations and Sources: Analysis based on industry reports from Brookings Institution, Peterson Institute for International Economics, MIT Supply Chain Management, and official announcements from Toyota, Honda, Subaru, and provincial governments. Trade data from USMCA official sources and automotive industry publications.